Property prices in Berlin continue to rise, leading to record sales on the Berlin property market. Here, we summarize the most important information from the Property Market Report 2015/16 by the Valuation Committee for land value and explain what that means for the guideline land prices and land prices in Berlin.

Overview of key figures

Turnover on the Berlin property market has risen by 35% to a record high of 18.1 billion euros last year. The number of property transactions rose by 21% to 35,244. The total area of sold land continued to rise by 11% to 1,166 ha. To illustrate, this corresponds to a land area of about 1166 football fields.

Undeveloped land

Sales of undeveloped land increased significantly by 45%. Even after sold land area, growth was still at 33%. Yet at the same time there were fewer transactions (-2%).

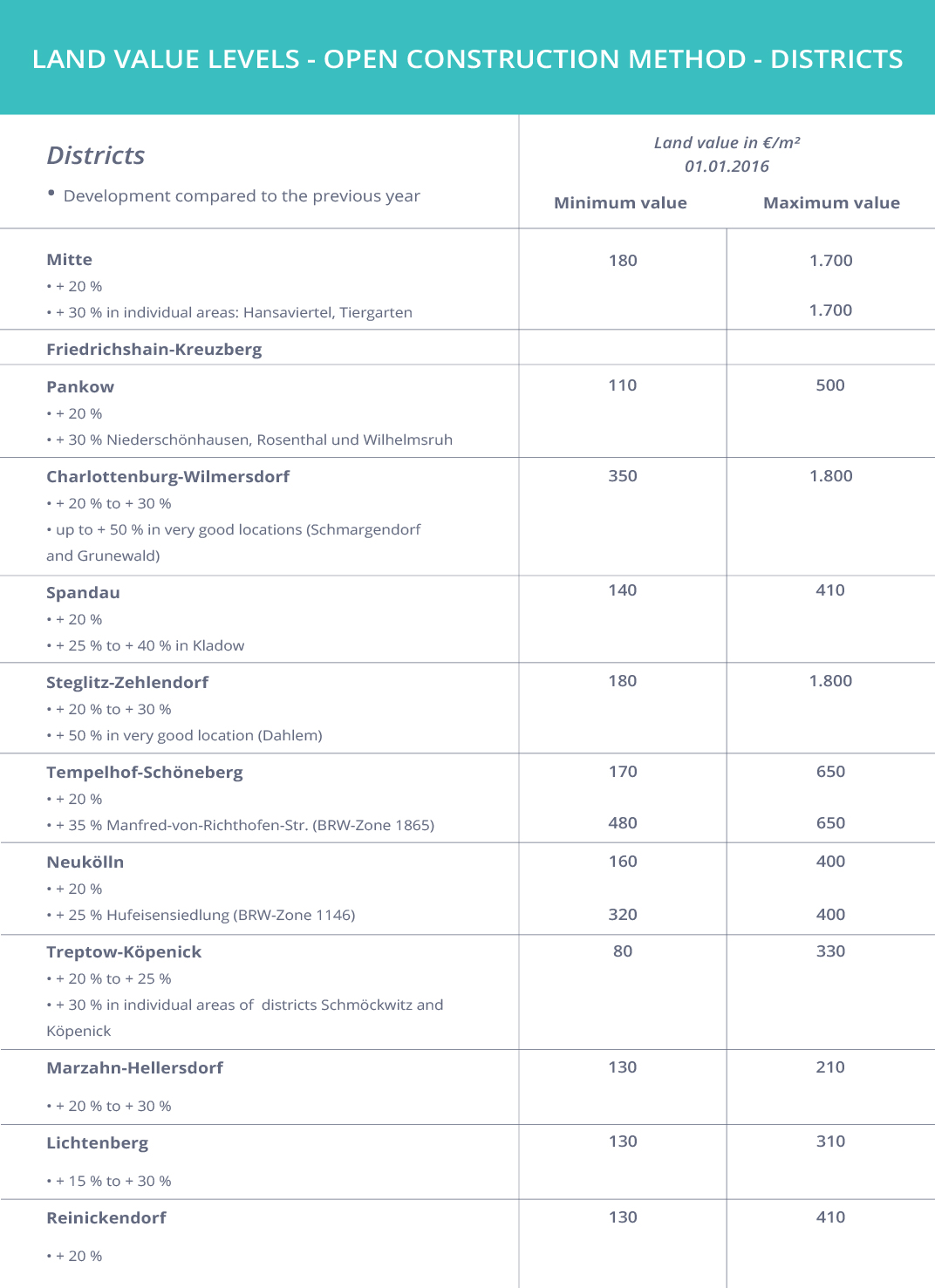

Due to the sustained demand for land for detached and semidetached homes, the guideline land prices were increased by an average of 20%. In very good residential areas in the southwest of the city (Grundwald and Schmargendorf), the land value was even increased by 50%. Each residential plot must be evaluated individually. On average, the guideline land prices for a residential plot in Schmargendorf are at a maximum of 1800 euros per square meter. Incidentally, if you wish to benefit from the attractive appreciation potential of this Berlin submarket, you can invest in the CALVIN BERLIN property in Berlin over iFunded.

Standard ground value in Berlin increased by an average of 20%

Berlin – Guideline land prices rise

In inner city areas, guideline land prices have been adjusted by 50% as strong demand for land for apartment buildings continues to persist. The demand for building ground with sufficient land area for the construction of apartment buildings exceeds supply by far.

Even outside the S-Bahn ring, the guideline land prices have been corrected upwards by an average of 30%. Accordingly, it is becoming increasingly difficult and expensive for families to find a residential plot of land. Many thus have to move to border areas where a suitable residential plot with the appropriate land area is still affordable.

Land prices in Berlin will continue to rise: the adjusting of the guideline land prices results in a considerable increase in the cost of planned construction projects. Since each individual residential plot can get a higher value on the basis of new guideline land prices, land prices will increase further.

Highest standard ground value in Charlottenburg-Wilmersdorf

Berlin – Land value levels

Guideline land prices as a parameter

What exactly do the guideline land prices indicate and how are they determined?

The guideline land price is a value that provides information about the average price of one square meter of undeveloped land. It is an auxiliary value used when determining the value of a residential plot of land or a property. The guideline land prices are calculated by the Valuation Committee for land values. To this end, the Valuation Committee has an insight into all notarized purchase agreements. This allows the Valuation Committee to calculate the prices per square meter for every property and each residential plot of land by analysing individual data such as the land area and the paid land prices. On the basis of those results, the existing guideline land prices are then adjusted.

As the Valuation Committee gets access to the purchase agreements, certain legislation applies to the creation of guideline land prices. These legislation can differ in the frequency the guideline land prices are determined for example, depending on the Bundesland. However, according to legislation, the survey must be carried out at least at the end of every second calendar year. In Berlin, the guideline land price is determined every year thereby deviating from the minimum requirement of the legislation. The legislation and the guideline land price are also an important part to determining the taxation of each plot of land.

Newly built residential property and conversions

The number of newly built residential units increased by 61% last year. Due to the continued high demand for condominiums, rental apartments are increasingly being converted to condominiums. Although the Senate has approved a regulation to prevent conversions, 17,331 rental apartments were converted into condominiums (+ 53%). For conversions Prenzlauer Berg is in the lead – with Kreuzberg, Charlottenburg, Wilmersdorf and Schöneberg also seeing an abrupt increase.

Conclusion

Finding a suitable residential plot of land has never been easy. It depends on many individual factors, such as the land area, the location and the price. However, the current development does not help in finding the “perfect” plot of land. According to the Valuation Committee the ever more scarce apartments and constant increase in demand are causing apartment prices and rents to continue rising. The same goes for the price of land in Berlin. This development can also be seen in the outskirts of Berlin. In the search for undeveloped plots of land, many families extend their search to areas near Berlin such as Brandenburg. These areas often still have suitable residential plots of land for construction of houses and land prices do not experience the same increases as in Berlin. Due to constant price increases, residential property in Berlin is still a very good investment. With iFunded you can now start investing small amounts into real estate projects and benefit from attractive interest rates.