There are various ways to invest in real estate via crowdfunding. Typically, the investors have acted directly as a lender. The mezzanine capital required by a project developer, or borrower, was put together out of a number of smaller loan amounts (of a maximum of 10,000 euros) from private investors. A newer approach is the purchase of loan receivables, based on a secured bank loan. This article explains how exactly this works and what the advantages are for the investor.

Investing via loan receivables works as follows

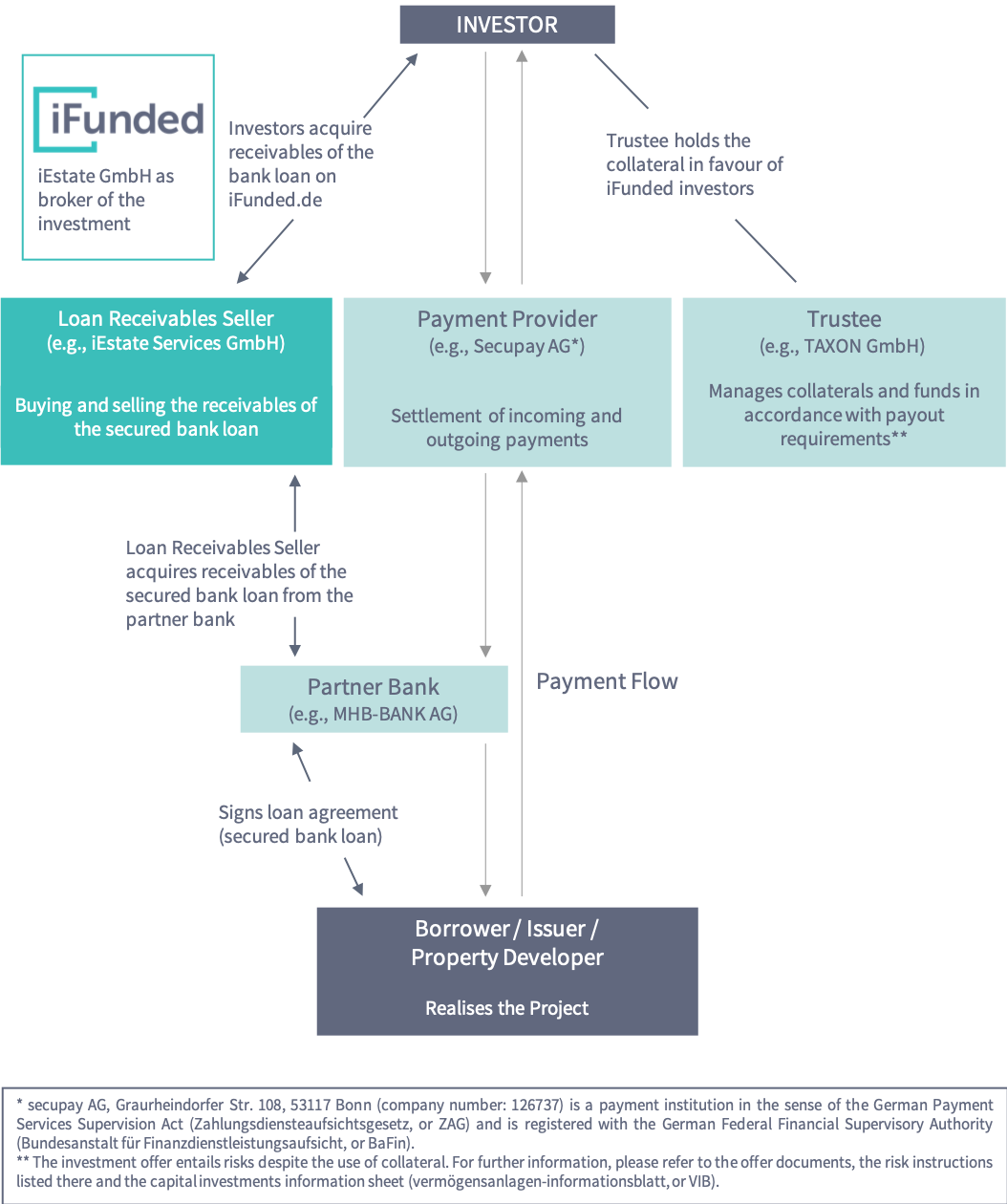

Unlike in the more traditional crowd investing described above, the investor no longer directly makes a loan to the project developer, or borrower. Rather, a bank acts as a lender and makes a secured bank loan to the borrower. The bank has receivables from the loan that are due from the borrower, i.e., the project developer: in essence, Essentially, these are the timely and complete repayment of the loan and the interest payments. Having made the secured loan to the borrower, the bank sells these loan receivables on to a separate subsidiary company of the iFunded platform (that is 100% owned by the platform). This special purpose vehicle is established solely for the purchase and sale of these loan receivables. Investors, in turn, may submit an offer to purchase these loan receivables via the investment platform at the specific terms and conditions of special purpose vehicle.

The advantage for investors

This structure has a very important advantage for the investor. The investment can be backed by real collateral. As collateral, the project developer could, for example, provide the trustee with a mortgage on a particular property or personal guarantee of the borrower. In the case of default, this collateral would be used for the benefit of investors. The granting of collateral is only possible through the involvement of the partner bank.